Donation

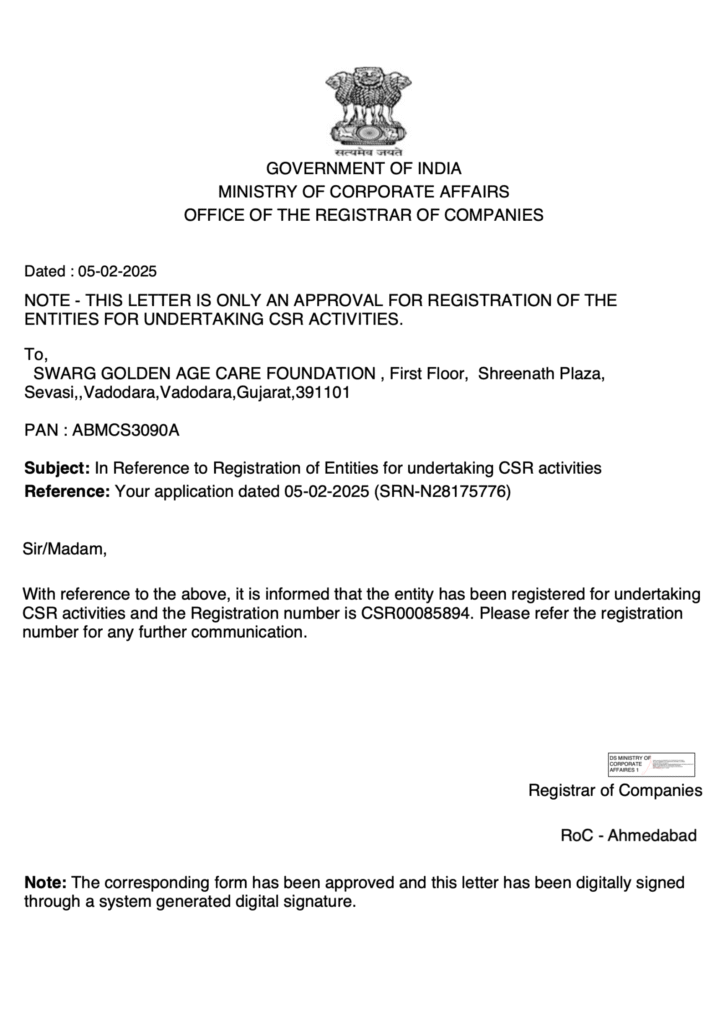

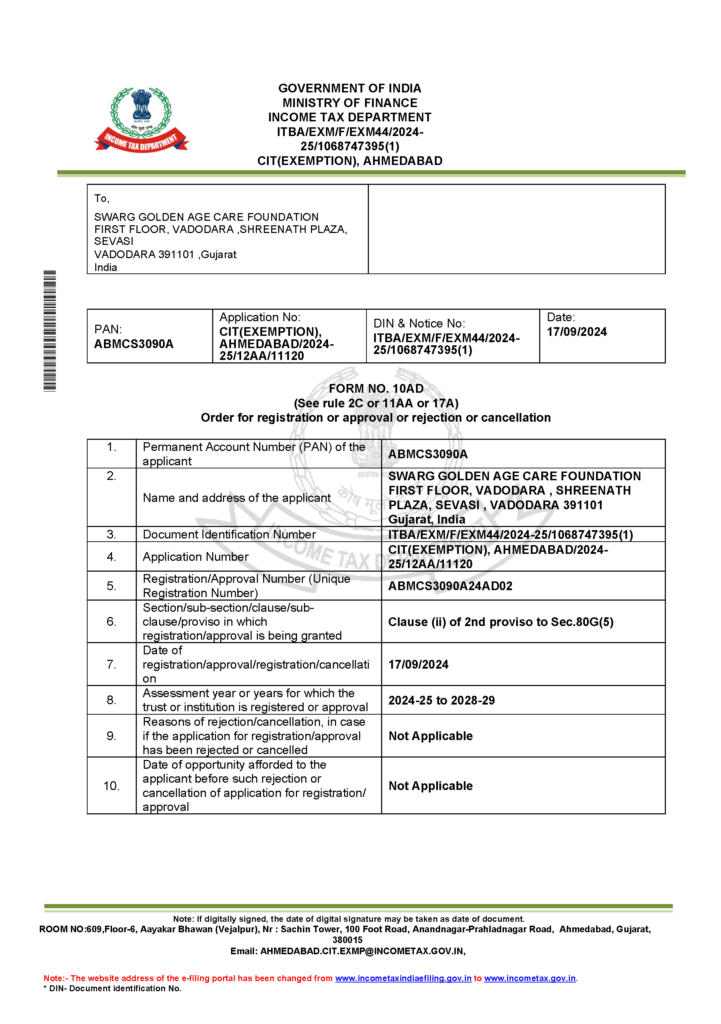

Donation covered under Sec 80G & 12A of Income Tax Act

Be the reason someone smiles today

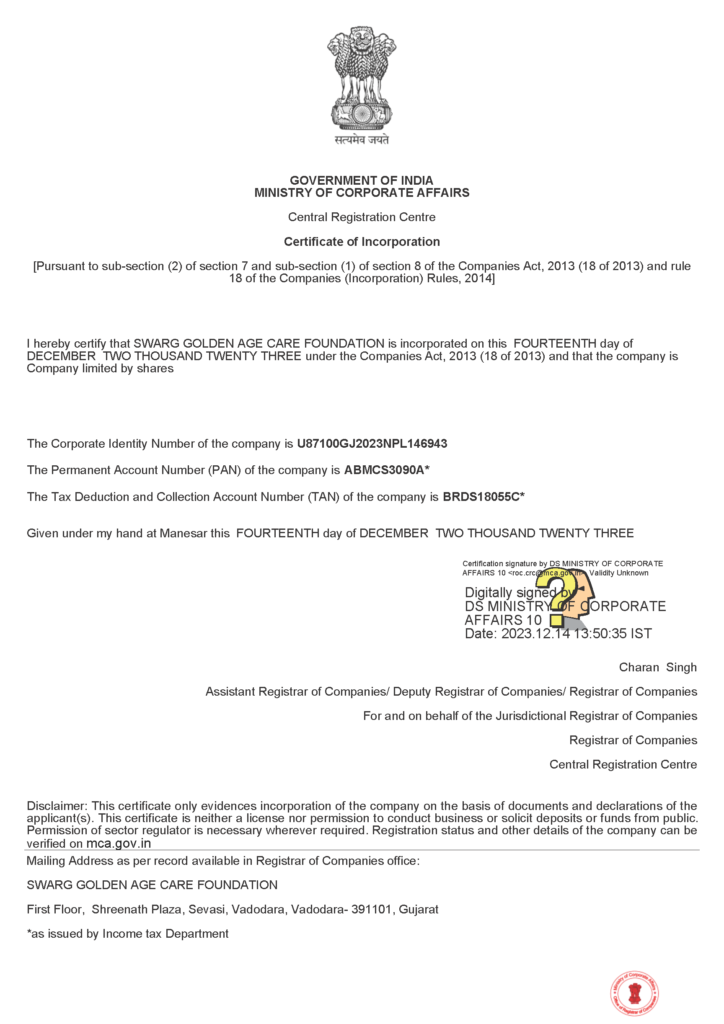

Welcome to Swarg Community Care Center, a haven of care and happiness for the elderly. Our mission is to bring smiles to the faces of our senior residents and you can be a part of it. By making a donation today, you can be the reason someone smiles.

At Swarg Community Care Center, we understand the unique needs and challenges faced by older adults. Our dedicated team is committed to providing a nurturing and supportive environment where our elderly residents can enjoy their golden years with dignity and joy.

Together, let’s make a positive change in the lives of our elderly residents and bring smiles to their faces. Donate today and be the reason someone smiles at Swarg Community Care Center.

SPONSORSHIP OF SWARG’S FACILITIES

Contribution Information

- DONATION WOULD BE MADE BY CASH, CHEQUE OR ONLINE TRANSFER

1. BY CASH

- Cash donation would be made at office

2. BY CHEQUE

- Cheque donation would be made in favour of “of “SWARG GOLDEN AGE CARE FOUNDATION”

3. BY ONLINE TRANSFER:

Bank Details

- A/C NAME: SWARG GOLDEN AGE CARE FOUNDATION

- A/C NO: 924020002545786

- BANK NAME:AXIS BANK, VASNA BHAYALI ROAD, VADODARA

- IFSC CODE: UTIB0004729

4. BY UPI

- SCAN QR CODE </bE

Faq

80G is a certificate that exempts you from paying taxes on the amount of money that you have paid as a donation to NGOs, charitable trusts, etc. that are registered. Donations to Narayan Seva Sansthan are exempt from 50% tax under section 80G of the Income Tax Act. The tax benefit is valid only in India.

Depending on the category of donation, the maximum donating limit for the Income Tax Act Section 80G deduction may vary. While in some cases, there is no maximum limit set for the deduction; while in other cases, the 80g tax exemption limit is set at a 10% of the adjusted gross total income of the charity donor.

There are 4 categories of donations made to NGOs or charitable funds, of which, categories 1 and 2 cover donations that are made to particular organisations or funds. Category 1 and 2 donations are eligible for 100% and 50% deductions, respectively, and have no qualifying or maximum limit.

Donations made towards the promotion of Family Planning, to any approved local authority or to the government fall under Category 3, whereas donations made to almost all other approved NGOs generally come under Category 4. Category 3 and 4 donations are eligible for 100% and 50% deductions, respectively, subject to a qualifying or maximum limit. Under 80G, any donation in categories 3 & 4 must not exceed 10% of the taxpayer’s adjusted gross total income, for it to make the 80G exemption list of 80G tax exemptions.

Donating to an NGO allows you to help further several initiatives and causes for the betterment of society, bringing happiness to a number of people. Being able to avail NGO tax benefits on your donation is another great advantage of donating money to an NGO. You can easily claim tax deductions on the donation, provided that the NGO is eligible under Section 80G of the Income Tax Act, 1961.

Tax exemption under 80G is applicable only to donations made to certain NGOs, charitable trusts, and similar institutions. The deductions are not applicable to donations made to religious trusts and other such establishments. The 80G tax exemption is unique as it provides tax deductions to the ones making the donation as well. According to the Income Tax Act, donating to savers tax deductible if it meets certain requirements, like: -

- Donee: The organisation or relief fund to which the donation has been made must be registered and validated with the Income Tax Department.

- Mode of Payment: To be eligible as a tax-deductible donation, it cannot exceed Rs 2000. Donations in kind also do not qualify for an 80G deduction.

- The Donation Limit: For claiming this as a tax-deductible, the donation (Category 3 & Category 4 Donations) must not exceed 10% of the donor’s adjusted gross total income.

Tax exemption in India is the removal or reduction of liability from making a mandatory payment that is imposed by the ruling power on a property, income, and so on. Tax exemptions on charity can availed when you make a donation to a charitable trust or NGO, provided the stated rules are met.

You can make donations under 80G to claim tax incentives. There are various categories of donations that are specified under Section 80G. They can be eligible for tax deductions of up to 100% or 50% with or without restrictions, provided they meet all the rules stated under Section 80G.